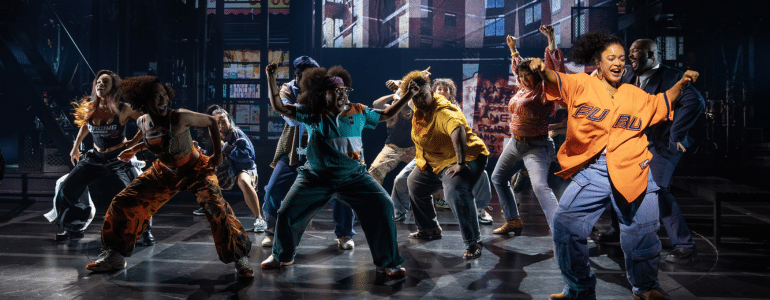

How Variable Pricing Has Helped and Hurt the Broadway Market

The history of pricing on Broadway:

Way way back: One price for each section.

Way back: Premium tickets for the best in the house. It first started with the Broadway Inner Circle on The Producers. $480 got you a private entrance and one of the best seats in the house. It was our first attempt to beat brokers at their own game.

The now: Finally catching up with airlines, ticketing analysts suggest new prices daily. Prices flex up and down with demand. Unlike airlines, this work is manual.

Variable Pricing is the reason why the $1 Million Dollar Club is no longer the cool club in town. Because of variable pricing, the big shows hit $2mm, $3mm and yes, The Lion King even posted a $4mm week.

While these cases are examples of the rich getting richer, Variable Pricing is a gift to all shows. Especially now, when $1mm is a common breakeven (!) for a new musical. Without being able to flex up when the demand warrants, more shows would lose more money.

But Variable Pricing isn’t all rainbows and puppy dogs. It’s got a dark side.

First, it gives a perception that all tickets are expensive. Why? Well, the expensive tickets are the only thing everyone (i.e. the media) talk about. And when those prime orchestra tickets for the hottest show in town are in the news, people believe that’s what all Broadway tickets cost. And that’s just not the case. (And don’t even get me started on articles that say “THEATER” tickets are expensive. Because I am happy to show you 100 ways to see inexpensive and great theater. It just might not be on Broadway.)

But there’s another way that Variable Pricing can hurt those shows in the middle of the market.

Back in the Way Way Back times. And even in the Way Back times. Shows sold out . . . all the time.

Now? Not so much.

Why? Is it because they are not doing well? Absolutely not. It’s because they are doing SO well.

When I was Company Manager, a Box Office Treasurer once asked me a trick question.

“Ken, would you want to sell your show out 8 times a week?”

“Sure,” I said.

“Nope,” he said. “You want to sell all but ONE seat. Only then you’ll know you’ve priced your house perfectly. If you sell it out, you might be leaving money on the table.”

And the hit shows used to sell out all the time. And fast. Gosh, when I wanted tickets to Phantom in the Way Way Back times, I waited nine months for balcony seats!

But now?

The hits increase prices as demand increases, slowing down their sell out . . . meaning they go into each week with tickets to sell.

Ten years ago? They didn’t.

Which means . . . ten years ago, new shows weren’t competing against the biggest hits in town. They were already sold out.

Now? A new show is competing with EVERYTHING, including the biggest hits in town, because everyone goes into every week with tickets to sell.

Yes, those tickets for those hits may be those expensive ones that the media loves to talk about. But they have tickets. And for a lot of tourists, who are here for the first time, and maybe the only time, they’re ok with shelling out more for the experience of seeing a Broadway show.

And thus we get $4mm grosses.

Which is fantastic for those big fat hits, who get bigger and fatter – but for the musicals getting off the ground? Variable Pricing can be an asset and a liability.

Podcasting

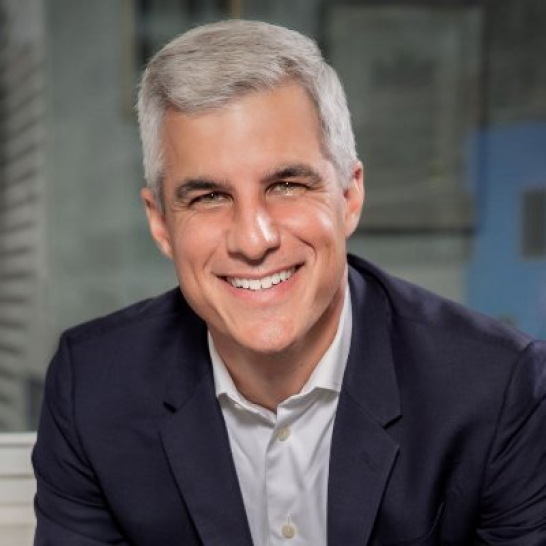

Ken created one of the first Broadway podcasts, recording over 250 episodes over 7 years. It features interviews with A-listers in the theater about how they “made it”, including 2 Pulitzer Prize Winners, 7 Academy Award Winners and 76 Tony Award winners. Notable guests include Pasek & Paul, Kenny Leon, Lynn Ahrens and more.