Somebody had to do it (and I’m thankful for it).

Simple 3 step business formula:

- Find something that causes a person a lot of pain.

- Come up with a solution to that pain.

- Sell that solution.

Here’s something that has been causing Producers a lot of pain. Ironically, it was born from something giving Producers a lot of pleasure: The New York City Musical and Theatrical Production tax credit.

The tax credit is a credit of up to $3mm (!) for shows that opened (or are opening) during these very tenuous post-Covid times . . . when costs are higher, and fewer people are coming. (Hey suburbanites – I’m talking to you! Come back! We miss you!)

It was a much needed incentive for Producers to spend money on shows and get a lot of people back to work. And, it’s working . . . evident by the record number of shows on the boards this season.

But one part of the credit isn’t working as well as Producers would like.

It’s taking time to actually receive the money. In most cases, a year and a half – or two.

I could say a lot about city and state systems, but in this case . . . I can’t blame them. It’s a brand new program. It’s up to a $3mm check. Theater financials aren’t the easiest to digest.

I think we all thought these checks were going to get to us as fast as that PPP money came during the early days of Covid. Or how fast that SVOG money came.

But that was a different time. And a federal program.

This is different.

And hey – this money is SUCH a gift, we can’t and shouldn’t complain.

The issue is . . . Producers can’t use that money to keep the shows open. Another $3mm in your hand could keep a show open and therefore people employed for weeks, even if the show was losing money. AND, if the show turned around (which is why you’d want to keep it open), it could catch fire, win an award, and run for months or years.

That’s why getting that cash credited back, and quickly, would be super beneficial.

I know they’re trying to speed it up, but it’s not quite there yet.

In the short term, a lot of Producers are seeking loans against that tax credit from other Producers, Investors, or in some cases, loaning it to the shows themselves.

It’s not easy, takes time, and who wants to ask your investors for more money when you’re in this situation?

In other words, what we have here is a PAIN POINT.

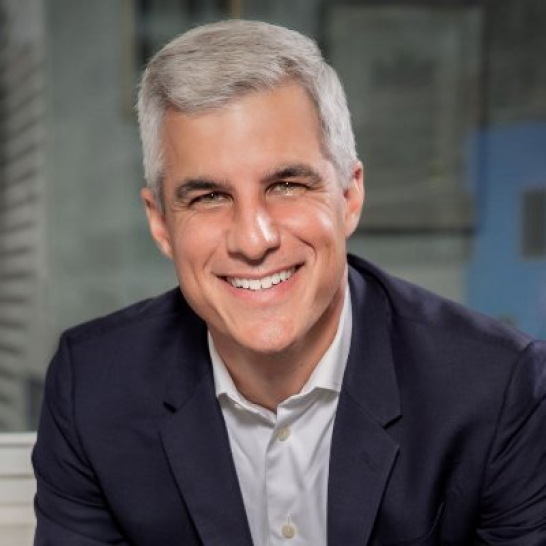

Enter stage left, Thomas Laub and Blue Fox Financing (“The largest network of lenders for independent film projects”). As reported by the one of the best journalists on the biz of Broadway we have, Mark Hershberg, this company is setting up loans to shows to get them the cash they need (and are due) and when they need it.

In other words, they have a SOLUTION TO A PAIN POINT.

And we owe them a debt (literally) of gratitude.

Now they will sell it, and I have a feeling, get a lot of buyers. (Unfortunately, with interest rates what they are, I’m a bit nervous as to the cost of this capital – because that simple business formula only works if there is profit to be made.)

Until, that is, the state and city speed up the delivery of that tax credit. Or until it disappears.

But more on that next week. Sign up here to make sure you get that article delivered straight to your inbox.

– – – –

Got a comment on this article? I want to hear it! I write these articles because I believe the world is a better place if there is more theater in it. And there is only more theater in the world if we’re talking about how to make more theater and better there.

And your comment will help!

Click here to comment on Facebook. Click here to comment on Instagram. Click here to comment on LinkedIn.Podcasting

Ken created one of the first Broadway podcasts, recording over 250 episodes over 7 years. It features interviews with A-listers in the theater about how they “made it”, including 2 Pulitzer Prize Winners, 7 Academy Award Winners and 76 Tony Award winners. Notable guests include Pasek & Paul, Kenny Leon, Lynn Ahrens and more.