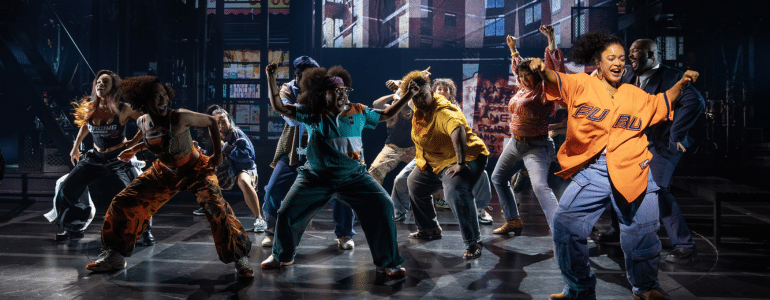

What Investment Guru Peter Lynch taught me about Broadway Investing.

You know me, I love to look outside our industry for tips on how to improve what I do every day. Since I’m a big believer in the theory that the entertainment industry should be its own investment asset class, I read a lot of investment advice to see if I can apply it to how I screen shows.

One of the best pieces of Broadway investment advice I ever received comes from one of the most important investors of the 20th century, Mr. Peter “Legend” Lynch, who took one mutual fund from $18 million to $14 billion.

So when Peter Lynch talks, people punch other people in the face to get them to shut up so they can listen.

One of Peter’s most important investing axioms didn’t have anything to do with P/E ratios or earnings per share or anything financial at all. It was simply . . .

Invest in what you know.

Peter believed that you should invest in companies that made products that you used every day. Not only do you understand those products, but more importantly if you used them, and if you were passionate about them, then other people would be too. And hopefully there would be enough of you to make that stock jump up.

I’ve applied that rule to picking Broadway shows to invest in or produce.

I only produce or invest in shows that I love. Or to put it in Peter’s terms . . .

Invest in shows that you would see every day.

The reasons why are twofold:

First, see above. If you are a huge fan of a show . . . and it gets under your skin and into your heart, there are probably a lot of other people that feel the same way. While that’s not a guarantee of success, it is a sign that you’re headed in the right direction. I would never invest in a show that someone else loves and you don’t, regardless of how much money you think it might make. Making a decision because you think you’ll make a lot of money is a surefire way to lose it. And be unhappy in the process.

Second, when you invest in something you love, and it doesn’t work out, it doesn’t hurt as much. Because you loved it. You are proud of it. You are glad it’s in the world, even though it might have cost you some money. You helped put art into the world that will have ripple effects all over this planet. (One of the shows I’m proud of that didn’t work here on Broadway was Mothers and Sons, from two seasons ago. While we didn’t recoup our investment, that play will be done in regional theaters and international locations for years, helping people understand how to heal with the AIDS crisis.) To use an analogy, I often refer to Broadway shows that you invest in like your kids. They are expensive, and they’ll often disappoint you. But you love ’em anyway. 🙂

Yes, I analyze budgets with a fine-toothed spreadsheet when considering investing in a Broadway show. Yes, I look at the pedigree of the creative teams before I write a check.

But I always start out with the simplest Lynch-like question . . . would I see this show every day?

Ask yourself that, and while you might not make money every time you invest, you will never go wrong.

Looking for more tips on investing in Broadway shows, or are you raising money and want to better understand the Broadway investing process? I’m teaching a seminar on the subject next Saturday, November 7th at 2 PM. Click here to learn more.

(Got a comment? I love ‘em, so comment below! Email Subscribers, click here then scroll down to say what’s on your mind!)

– – – – –

FUN STUFF:

– Listen to Podcast Episode #43 with Broadway Director John Caird! Click here.

– Win 2 tickets to Story Pirates! Click here!

– Want to learn the ins and outs of Broadway Investing? Click here to sign up for my Broadway Investing seminar on 11/7.

Podcasting

Ken created one of the first Broadway podcasts, recording over 250 episodes over 7 years. It features interviews with A-listers in the theater about how they “made it”, including 2 Pulitzer Prize Winners, 7 Academy Award Winners and 76 Tony Award winners. Notable guests include Pasek & Paul, Kenny Leon, Lynn Ahrens and more.